Jon Schalliol explores how, when it comes to investments, geographic boundaries are much less important than intellectual ones.

This summer I took part in a session at the Global Entrepreneurship Network 2025 Congress, with investor representatives not only from countries with large venture bases, like the U.S., the U.K. and Israel, but also from those working to develop their venture ecosystems, like Jamaica, Nepal and Indonesia. The session was focused on identifying how to enhance venture investing in those countries with less well-developed ecosystems, and while I shared some of my thoughts, it got me thinking more deeply about the misconception that investors can just identify a good founding team with a great value prop and plan wherever they are.

Investment History

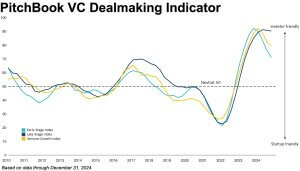

Across decades of research, venture capital allocation consistently exhibits a strong ‘local bias’, with most investors preferring startup companies located within an hour’s drive or a few hundred miles of their offices: A 2023 Journal of Banking and Finance paper found a statistically significant negative relationship between geographic distance and VC fund allocation, demonstrating that VCs invest less as distance increases. This intuitively has felt correct for quite some time, but since COVID as in person pitches have become far less common, we’re seeing a widening geographical footprint across many investors we know (also reflected in the data). For context: Bay Area startups raised about $90B in 2024 (~57% of U.S. VC). The network effects remain, and investors who stay close to home are going to find more deals close to home.

An International Portfolio

In our case, most of our deals come from referrals from other investors, and we identify most closely with investors that are focused on our sectors, wherever there are located. While we are based in the U.S. and located in the ‘Hardtech Corridor’ of the Midwest through The Heritage Group, we are open to many more geographies—because great ideas really can come from anywhere. The United States isn’t always the best place to start a particular business, especially when the more stringent regulatory environments serve as a catalyst for innovation that later migrates throughout the world. Entrepreneurial ecosystems abroad are improving dramatically, and Startup Geonome is now listing Beijing tied with Boston at #5 and Bengaluru-Karnataka at #14 in its ‘Global Startup Ecosystem Ranking’, so I expect we’ll see the rate of exciting companies from abroad flourishing.

Some of the most compelling technologies we’ve backed originated far from our headquarters. Germany-based INERATEC is pioneering synthetic fuels to decarbonize hard-to-abate sectors like aviation and shipping; UK startup Puraffinity was spun out of Imperial College London and is at the forefront of PFAS removal, a pressing water issue worldwide. Valerann, an Israeli-founded company is making connected roadways smarter and safer. Further, Material Evolution in the UK is making low-carbon concrete viable.

Beyond these direct investments through HG Ventures, The Heritage Group has also supported a broad array of international entrepreneurs through The Heritage Group Accelerator. Over its six-year run, the accelerator welcomed startups from many other countries, including Belgium, the Netherlands, France, Finland, Norway, and Estonia in Europe; Colombia and Chile in Latin America; and India, Singapore, and New Zealand in Asia-Pacific. These founders all brought bold ideas and impressive drive—and The Heritage Group was proud to support their businesses.

Practical Considerations

Of course, we’d love to invest in every great company that we can help, no matter where it originates, but sometimes practical considerations stand in the way:

- Venture-oriented ecosystems and governance: The first consideration is the area that was the topic of discussion at the recent Global Entrepreneurship Network Congress. Some countries just do not have in place the legal and governance infrastructure necessary to enable startups to thrive. In the U.S., the standards of the National Venture Capital Association (model docs here!) exist to create clarity around governance and protect all parties. These have been developed over time and, together with entrenched and accepted legal frameworks, give VCs the confidence to take the risks inherent with venture investing without any ambiguity over common questions such as whether there is a Board of Directors; who sits on the Board; who gets a vote on major actions; or what to do if a change in the management team is warranted. Investors putting up large sums of money need to have a say on major issues like this. Venture investing is risky enough with clarity around these questions, but without that clarity, it is hardly surprising that most VCs would rather pass than take the risk.

- Employment laws: Startups need to be nimble, able to respond quickly to changing market conditions and competitive threats and opportunities, pivoting where necessary. The reality is that this often requires the ability to hire—and yes, fire—quickly. The inability to do so creates the kind of burden that can cripple startups, making countries with employment laws that are limiting much less attractive investment prospects. The OECD provides a helpful list of Indicators of Employment Protection that exposes some of these constraints.

- Local knowledge: We’re also a deliberately small team, which means we can’t have deep, firsthand expertise of every international market—and the same applies to most VC firms. For that reason, we always syndicate with an experienced co-investor on the ground with local knowledge, networks and physical proximity. There is no substitute for sitting in a room and working through challenges together, and while we are willing to put that effort in, it’s difficult to do that at the at a moment’s notice—or in case of a global pandemic.

- Adding value: We talk routinely about how we invest in companies where we can add value beyond capital. While the value add often pertains to expertise across The Heritage Group and is extensible anywhere, often its networks and operating companies can help directly. THG has operations in North America and parts of Europe and China, so our ability to help in outside these geographies is often reduced.

It boils down to this: If an investment opportunity carries greater risk because of geography, then the expected return on investment also needs to be outsized if it is to warrant serious consideration.

Seeking Opportunity

Our ambition to back the best companies we can help wherever they are is undiminished—constraints we have identified don’t limit our enthusiasm for international innovation, they just ensure that when we do invest, we can be the kind of partner every founder deserves. That’s a commitment we take seriously.

Many startups face a constrained fundraising environment. We want those founders to know: HG Ventures is actively seeking new investments. If you’re building something transformative in materials, energy, water, infrastructure or software around our industries, and you’re looking for a partner who brings more than just capital, we’d love to talk.

PinPoint Analytics: In September we led the investment round for AI-powered construction data platform,

PinPoint Analytics: In September we led the investment round for AI-powered construction data platform,