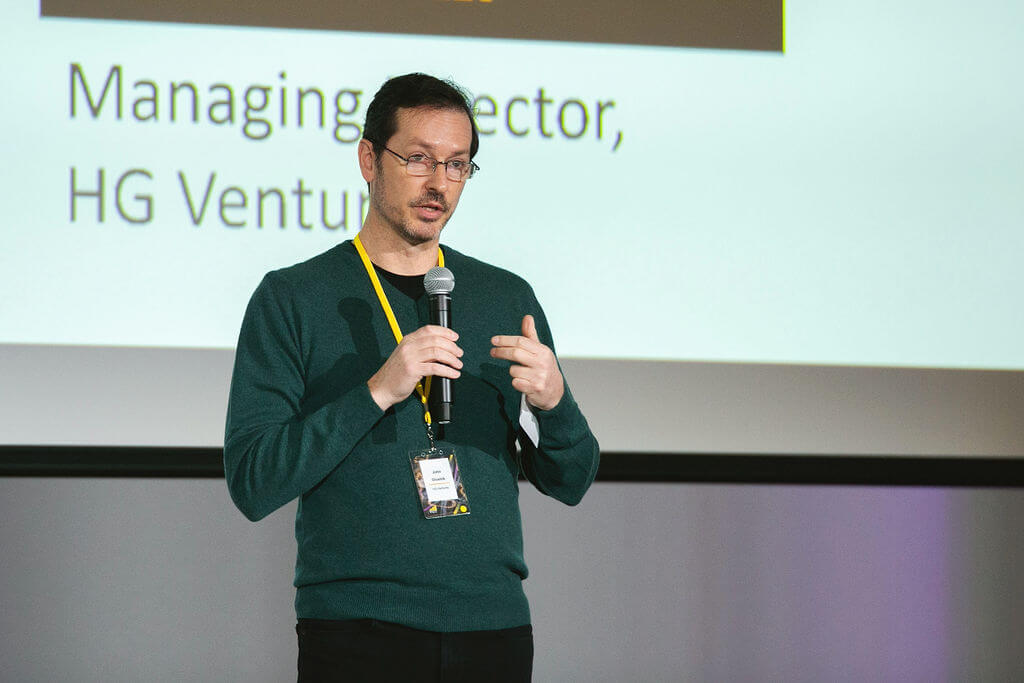

With 25 years’ experience in the world of venture capital, HG Ventures’ Managing Director John Glushik has witnessed a wide range of investor behavior. Here John shares his perspective on what makes a good investor partner, and how his team applies this philosophy at HG Ventures.

The relationship between startup founders, executives and investors is an extremely important one, and, like any relationship, it requires an aligned set of values, mutual respect, empathy and understanding, give and take, and clear boundaries to be successful.

It sounds simple enough, yet I often see examples where there is a power imbalance, friction or antagonism, and on occasion a complete breakdown in the relationship. How does that happen? And how can it be avoided, by entrepreneurs and investors alike?

The Anatomy of a Good Venture Capital Investor

These four key attributes represent my own perspective and are by no means exhaustive, but they serve me and our portfolio companies well:

- Mutual Respect and Appreciation: The venture capital industry would not exist without entrepreneurs. Too often, investors treat founders like they are subordinates, with an attitude and expectation that they must “grovel” for capital and adapt to whatever process the investor requires. Our team is intentional with our values and standards which include showing respect and supporting entrepreneurs regardless of the ultimate investment decision. We also adapt our process to theirs whenever possible.

- Alignment of Vision and Values: A successful partnership begins with shared objectives. A good venture investor aligns their vision with that of the entrepreneur so that collaboration can most effectively propel the company forward. An understanding–and sharing–of an entrepreneur’s mission, values, and long-term goals are essential for establishing a foundation for partnership.

- Accessible and Approachable: Accessibility breeds trust. A good investor remains approachable, fostering an open line of communication with founders and executive teams, and not limiting contact to the confines of a quarterly Board meeting. This transparency not only nurtures a strong working relationship but also ensures that challenges are addressed promptly, fostering a culture of continuous improvement.

- Partnership Beyond the Check: More than just financial backers, good venture investors serve as partners. Being a startup founder can be a lonely position, and the value that a good investor should be much greater than just writing a check. Good investors actively participate in the growth journey of the companies in which they invest, offering strategic guidance, leveraging their networks and suggesting solutions, as opposed to just raising issues or concerns. At HG Ventures, we are always asking ourselves how we can help tackle challenges and how we can add tangible value for our portfolio companies.

What Entrepreneurs Should Look For

If we think of the investor-founder dynamic as a relationship, then it is a pretty unusual one. In no other sphere would one make such an important, long-term commitment after relatively limited interaction.

So what should a startup’s executive team be looking for in an investor?

- Proven Track Record: Entrepreneurs should scrutinize the track record of a would-be investor. A successful investor will be able to demonstrate not just a track record of guiding companies to successful exits, but also a history of nurturing companies through various stages of growth, through the tough times as well as the good ones. Look for those who have a knack for identifying both challenges and opportunities, and ultimately delivering on promises.

- Understanding of the Industry: A good investor should have a good grasp of the founder’s industry; but a word of warning here: It is not possible for us to be an expert in every field in which we invest. We are full-time investors, that is our area of expertise. So while entrepreneurs should ideally seek partners who possess some understanding of their sector, investors and founders alike also need the humility to recognize and appreciate their strengths and weaknesses. At HG Ventures, we provide industry expertise through our colleagues within The Heritage Group. They can deliver unique market and technology knowhow to our portfolio companies.

- Value Beyond Valuation: The size of the check or the valuation should not be the sole driver of the choice of investor. The founder’s journey can be long and difficult, and the financial aspect of the partnership is just the start. Further down the road, a founder is going to need advice, empathy, and sometimes someone to deliver some tough love. That’s where the real value comes in. There is a practical aspect to this, too: What value can the investor deliver by way of their network and relationships? This is a core part of our value proposition at HG Ventures: Our starting point is always to ask: “How can we help?” In the recent past that help has taken the form of giving startups access to the research and development resources of The Heritage Group, and introductions to The Heritage Group’s operating companies to test product-market fit and develop go-to-market strategies.

The Investor’s Covenant

Beyond the boardroom, a good investor is an advocate for founders. It is the investor’s responsibility to champion the entrepreneur’s vision, ensuring that the company stays true to its core values while navigating the challenges of growth.

Understanding the delicate balance of Board dynamics is vital. A good investor must be flexible, navigating Board dynamics, and support management teams while also holding them accountable and focusing on increasing value for all stakeholders.

Investing is not a sprint; it’s a marathon. A good venture investor is committed to the long-term success of the companies in their portfolio. This commitment extends well beyond the initial investment, with an unwavering dedication to seeing the venture thrive.