Jon Schalliol reflects on a year of new investments, successful exits and portfolio momentum.

The venture capital landscape in 2025 has been marked by cautious re-engagement. After a turbulent 2022–2023 and a flat 2024, investor appetite began to pick up again, though certainly not evenly across all sectors, stages or investor types.

According to PitchBook’s H1 2025 VC Tech Survey, just over half of investors (53%) described themselves as “actively hunting for deals,” while a significant minority (34%) were still pulling back, and 44% said they had completely paused activity until market signals became clearer. That mix of stances reflected an industry still recalibrating its risk tolerance and redefining what constitutes a “good deal.”

Amid this caution, AI remained the biggest draw for capital. PitchBook’s Q3 2025 Global VC First Look reports that AI startups captured more than half of global deal value this year and accounted for nearly a third of all completed venture transactions. But that tidal wave of capital also narrowed the field, with less attention paid to deeply technical, capital-intensive sectors like hard-tech, industrial systems, or circular economy innovations.

We believe that creates opportunity.

Unfortunately, we saw several CVCs shut down or pause investing as their corporate parents “focus on the core,” but HG Ventures continued to deploy capital into infrastructure, industrial tech, materials, and climate resilience and other areas that benefit from the kind of operational leverage our partnership with The Heritage Group enables.

New Investments in 2025

In 2025 we welcomed several companies that align with our thesis of industrial systems innovation:

- Voxel: We participated in the Series B round of Voxel, which raised $44 MM to scale its AI-powered workplace safety platform. Despite most companies having a heavy focus on improving safety, 2.78 MM workers lose their lives every year to work-related incidents globally. Voxel is putting AI to work in helping organizations prevent accidents before they happen by identifying potential hazards and unsafe behaviors in real-time, enabling supervisors and safety managers to take immediate action. It’s proactive incident prevention at scale. Voxel subsequently received a further strategic investment from Ericsson Ventures, further demonstrating its momentum.

- FREDsense: In September, we led the $7 MM Series A investment round in FREDsense, a pioneer in rapid water testing technology. The company has launched the first commercially available field-based PFAS detector. By replacing lengthy lab turnaround times with same-day answers onsite, FREDsense enables onsite teams to identify contamination hotspots, verify cleanups, and optimize treatment more efficiently and at lower cost. Per- and polyfluoroalkyl substances (PFAS), often called “forever chemicals,” have become a global environmental and public health concern, and startups are at the forefront of developing the means of their detection and destruction. FREDsense joins other companies in our portfolio addressing this issue: Puraffinity is advancing adsorption-based removal, and Aclarity is developing groundbreaking electrochemical destruction methods to eliminate these chemicals entirely. Taken together, these investments form a comprehensive toolkit for tackling PFAS contamination, from detection to removal and destruction. Ginger Rothrock writes about our investment rationale in this area, here.

A FREDsense PFAS detection field kit. - StreetIQ is an AI-powered digital platform that enables local governments to assess the need for road repairs and optimize those repairs, thereby making the most of infrastructure budgets. Our Future of Roads report analyzed the opportunities for technology to improve road infrastructure, and StreetIQ is a great example of that in practice.

- And More! We invested in three additional companies toward the end of 2025 that have yet to announce the investment, and we hope to share details soon.

Follow-on Investments in 2025

Building on our existing partnerships, we made ten follow-on investments to deepen our support and signal continuing confidence. Those that have been announced include:

- ElectraMet: We kicked off the year by participating in ElectraMet’s $10 MM Series C funding round. ElectraMet is transforming industrial waste streams into engineered materials, and Ginger Rothrock sat down with ElectraMet’s CEO, Keith Jacobs, and Chief Technology Officer, James Landon, to talk about the company’s journey to date and plans for the future. Read highlights of that conversation here.

- PinPoint Analytics is built on deep data science and construction data insights and uses AI to modernize how infrastructure projects are planned and bid. To support the company’s continued growth and successful execution of this partnership, we led a $2.3M extension round.

Successful Exits

Venture capital is a long-term asset class and now that HG Ventures is roughly 7 years old, we are glad to see more of our investments mature, with two successful exits this year. We are grateful for the hard work of the management teams that got these companies to that point, and are proud to have been able to leverage our relationships to help along the way:

- Gauge is a company that provides cloud-based software to help construction and infrastructure companies manage, track, and optimize heavy equipment fleets, for better utilization and lower costs. We first invested in Gauge in 2019 and have been strong supporters—, The Heritage Group became a major customer. We were pleased when Gauge was acquired by XBE (a strategic software provider backed by PE firm, Banneker Partners).

- Epogee is the food technology firm behind EPG, a plant-based fat alternative that significantly reduces calories and fat without compromising taste or texture. Our fit here was in the science and production of chemistry that makes this incredible product possible. We identified the potential for EPG early on and earlier this year that potential was also recognized by Peter Rahal of David, a fast-growing brand that helps to increase muscle and decrease fat. David closed a $75 MM Series A funding round and simultaneously acquired Epogee in a transaction that brings David into our portfolio.

Portfolio Milestones and Accolades

This year has seen impressive impact by many of our portfolio companies, and these are just a few of the highlights:

- Five of our portfolio companies were recognized for their groundbreaking contributions to sustainability and innovation, in the Global Cleantech 100 list, a comprehensive showcase of the most promising private companies in the cleantech ecosystem: INERATEC, ZwitterCo, Circulor, Aclarity and SOLARCYCLE are driving meaningful change in areas like renewable fuels, water treatment, supply chain traceability, and circular economy solutions.

- INERATEC, a German manufacturer of synthetic fuels, had a big year and secured a €70 MM funding commitment to scale sustainable e-fuels and launching its ERA ONE plant near Frankfurt. ERA ONE is Europe’s largest power-to-liquid fuels plant, with the capacity to produce 2,500 metric tonnes (825,000 gal) of e-fuels per year, predominantly sustainable aviation fuel (e-SAF).

- INERATEC was not the only one of our portfolio companies to open a new production facility, and Material Evolution’s ultra-low carbon cement plant in Wrexham, Wales, became the UK’s largest producer of sustainable cement. It offers a scalable, high-performance alternative that significantly reduces emissions. Cement production is responsible for nearly 8% of global CO₂ emissions, and traditional cement production is a major contributor.

- We see growing opportunity in the application of AI and automation to core industrial challenges. That includes PinPoint Analytics, which brings predictive intelligence to cost estimating and recently launched a partnership with the SOVRA procurement platform—used by over a million suppliers—to bring advanced cost estimation tools to public sector suppliers across North America.

- Pretred, a Colorado company that manufactures sustainable safety barriers from recycled tires, had its Colorado Rubber Barrier certified for use on U.S. roadways. Every Pretred barrier helps turn waste tires that would otherwise be incinerated or go to landfill into a sustainable solution, replacing carbon-intensive concrete or plastic barriers.

- SOLARCYCLE took some major strides forward this year, signing a solar panel recycling agreement with RWE, one of the largest clean energy operators in the U.S. And in a breakthrough in solar circularity, the company developed a proof-of-concept solar panel made with 50% recycled glass from end-of-life solar panels.

- Earlier in the year, Valerann secured a €3.6 MM contract from the European Space Agency to develop an AI-driven traffic monitoring platform that will integrate satellite data with ground-based sensors, and the company recently rolled out its technology on a nationwide scale in the Republic of Ireland.

- Not content with solving just industrial challenges, ZwitterCo is expanding into the food processing sector, with the introduction of its Evolution membranes. Membrane technology, which uses selective barriers to separate and purify fluids, is essential to processes like milk concentration, protein recovery, and water reuse. But many membranes degrade quickly when exposed to fats, oils, and proteins. ZwitterCo’s platform, built on its patented zwitterionic chemistry, is engineered to resist fouling and maintain long-term performance, reducing downtime, waste, and cost.

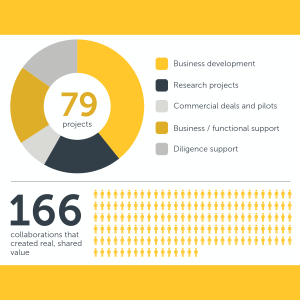

Adding Value Through The Heritage Group

Throughout the year, we seek to leverage the incredible wealth of talent within The Heritage Group’s operating companies, to the mutual advantage of them and our portfolio companies.

This and every year we are grateful for the generosity of our THG colleagues in sharing their time, insights and expertise.

The HG Ventures team

Of course HG Ventures is a team, and we were grateful to bring aboard two new amazing colleagues in 2025:

- Natalie Cira joined the team as a Principal.Prior to HG Ventures, Natalie was a Principalat BHP Ventures, where she led or co-led investments in companies focused on industrial decarbonization, water treatment, and sustainable

extraction technologies, experience she is bringing to bear at HG Ventures. - Sarah Schlifke also joined us, as Platform Manager, an important role that strengthens our ability to add value by connecting portfolio companies with The Heritage

Group’s operating companies. Read more about Sarah’s role and the experience she brings, here.

We were thrilled to recognize the contributions Ginger Rothrock continues to make to the team and our portfolio through her promotion to Managing Director. Personally, I’m grateful to partner with Ginger every day, and I’m excited to see what she’ll drive for HG Ventures in this expanded role.

Leading the Conversation

This past year we once again engaged meaningfully in discourse with and about the worlds of venture capital and the industries in which we invest, through events, panels, podcasts and more. Among the highlights:

- John Glushik participated in a panel at the Global Corporate Venturing Summit, discussing “How corporate venture arms can drive real impact.” John summarizes his thoughts on that topic here.

- Ginger Rothrock attended the Circularity 25 conference in Denver, highlighting the critical role that startups and their partnerships with corporates can play in building a circular economy. While she was there, Ginger also took the time to appear on the Circularity 25 podcast.

You can read Ginger’s key takeaways from this important conference here.

Also at the GCVI Summit, I joined Munich Re Ventures’ Alex Kamenetskiy and Merck’s David Stevenson to lead a session that introduced a new community for those responsible for Operations and Finance functions within corporate venture capital. This initiative was in part born out of the GCV Finance and Operations Forum that we were proud to host in 2024 and it’s encouraging to see the momentum continuing.

Also at the GCVI Summit, I joined Munich Re Ventures’ Alex Kamenetskiy and Merck’s David Stevenson to lead a session that introduced a new community for those responsible for Operations and Finance functions within corporate venture capital. This initiative was in part born out of the GCV Finance and Operations Forum that we were proud to host in 2024 and it’s encouraging to see the momentum continuing.- Ginger was also invited to share her insights elsewhere this year, including the podcasts, Make Water Work and Selling Circular, and in the pages of the Indianapolis Business Journal.

- Ginger was not the only member of the team in demand as a podcast guest, and John Glushik was invited on to Innovators & Investors to share details of what we look for in a startup, and how we work to accelerate growth post-investment. In a candid interview, John shared his views on what makes a capital partner truly “value-add”, what founders really need from their investors, and why corporate venture capital, done right, can outperform traditional models.

- Members of the team attended important events on both coasts, including New York City Climate Week and CVC Week in San Francisco, in which both Ginger and I participated. And when the BOLT conference came to Indianapolis we invited delegates to visit us ‘at home’ at The Center, co-hosting a networking event for corporate VCs, alongside Global Corporate Venturing and Gener8tor.

- Also in Indianapolis, I represented HG Ventures at the Global Entrepreneurship Network 2025 Congress, alongside investor representatives not only from countries with large venture bases, like the U.S., the U.K. and Israel, but also from those working to develop their venture ecosystems, like Jamaica, Nepal and Indonesia. The session was focused on identifying how to enhance venture investing in those countries with less well-developed ecosystems, a subject on which I reflected further, here.

These contributions reinforce how we aspire to take a lead in the narrative around industrial innovation, corporateventure and systems-level investing.

Industry Recognition

It is always gratifying when our contributions are recognized by our peers, so it was great to see John Glushik once again named one of the 50 most influential figures in corporate venture capital, globally, through his inclusion in the GCV Powerlist.

It is always gratifying when our contributions are recognized by our peers, so it was great to see John Glushik once again named one of the 50 most influential figures in corporate venture capital, globally, through his inclusion in the GCV Powerlist.

It was humbling for both me and Ginger also to be recognized byGCV, as two members of the list of 100 ‘Emerging Leaders’ in corporate VC.

Recognition is not why we do what we do, but it does validate our approach and strengthens our ability to attract the very founders and companies we believe in.

What’s Next

As we head into 2026, our resolve remains unchanged, and we look forward to finding and supporting founders and teams that are building scalable solutions where we can add value. We enter this new year optimistic and ready for whatever’s next.