Unicorns, puppies and pieces of pie: A guide to venture capital and trends in sustainable investment

HG Ventures’ senior director, Ginger Rothrock recently delivered a keynote address at the SP Innovation Summit, organized by the automotive industry’s Suppliers Partnership for the Environment. Here, Ginger outlines some of the insights into the world of venture capital that she shared with the Summit’s delegates.

Ask me what we do at HG Ventures and you will have a hard time getting me to stop talking.

It is easy to forget that not everybody inhabits the same world, where scientific innovation meets venture capital, so it is sometimes necessary to boil things down to their essence:

- We buy a piece of the pie, with the aim of growing the pie: Most entrepreneurs get to the point where they need an injection of capital in order to scale their business, and that’s where venture capital comes in. In the simplest of terms, we buy a share of the business, based on a current valuation and an assessment that by putting that capital to use, that business will eventually grow to become much larger. Everybody wins.

- High reward often comes with high risk: We are looking to invest in businesses that have the potential to deliver a high return on our initial investment. Generally speaking, that means taking a risk, and very often the higher the risk, the greater the reward.

- They are called unicorns for a reason: In the world of venture capital, a ‘unicorn’ is a venture-backed business with a valuation of $1B or more. Needless to say, these are exceptionally rare; for every 1,000 deals done, less than 1% will go on to achieve that sort of valuation. Less than 1% will exit between $500 million and $1 billion; another 100 or so have some sort of exit that at minimum returns an investor’s capital. That leaves us 900 companies.

-

Yes, nine out of ten VC-funded companies fail. But the ones that succeed make up for all the failures.

- Entrepreneurs are our customers: The entrepreneur is the creator of all the value in the venture capital business. If there were no entrepreneurs, there would be no venture capital. So we treat the entrepreneur like our customer; we are in the services industry, and invest heavily to make sure entrepreneurs get appropriate attention and resources.

-

That said, HG Ventures has probably 20 new deals a week out of over 100 inbound that are relevant to our investment interests. We invest in about five per year, which means about 995 entrepreneurs (customers) are turned away.

-

We work hard to make quick decisions and be forthcoming on reasons why we pass. Often our response includes a “not now” – we never want to close the door to possibly investing in an entrepreneur in the future. You can easily see how the ratio of companies inbound to companies funded makes for a challenge in customer relations.

- Startups are like puppies:

Just like adopting a puppy (which our family recently did – see gratuitous puppy picture with my youngest daughter), we must actively nurture and support startups. At HG Ventures we do everything we can to help, providing our investments with access to our resources, our contacts and our customers. Anyone can make an investment; generating a meaningful return by growing and exiting an investment is the tough part.

Just like adopting a puppy (which our family recently did – see gratuitous puppy picture with my youngest daughter), we must actively nurture and support startups. At HG Ventures we do everything we can to help, providing our investments with access to our resources, our contacts and our customers. Anyone can make an investment; generating a meaningful return by growing and exiting an investment is the tough part.

Bouncing back from a tough year

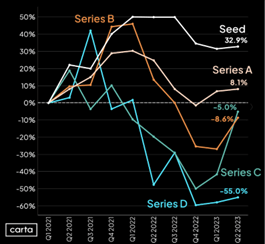

Valuations of venture-backed startups have mostly declined since Q1 2022, causing VCs to be a lot more discerning about how, where and when they invest.

But 2023 is shaping up to be different from 2022. Every stage, from seed to series D, saw the median pre-money valuation rise this last quarter (according to Carta). And four of those stages (seed, A, B, and C) have valuations above or just below Q1 2021. I’m optimistic; however, the volume of deals is still considerably down from 2021 and early 2022.

But 2023 is shaping up to be different from 2022. Every stage, from seed to series D, saw the median pre-money valuation rise this last quarter (according to Carta). And four of those stages (seed, A, B, and C) have valuations above or just below Q1 2021. I’m optimistic; however, the volume of deals is still considerably down from 2021 and early 2022.

There still remain startups that were funded during the “good times” that are now struggling with their inflated burn rate, have not really found product-market fit, have challenges achieving positive unit economics, or other factors.

These startups will struggle to raise capital, and most of them will fail. Yes, they are part of that 90%.

Myths and facts about investing in hard tech

“Hardware is hard”, say investors, LPs, and even founders in this sector.

There are plenty of quips around the trials associated with building and funding companies commercializing physical objects and applied science; and that this sector is a much harder path than building software. Of course, HG Ventures believes that today’s scientist and engineer entrepreneurs are creating the next generation of unicorns. Happily, other investors are starting to align with this idea.

Over the past four years, B2B SaaS has dominated, accounting for 42% of all VC investment in priced rounds in 2019 and 30% in 2023. Consumer and fintech also were significant categories in 2019; both categories have experienced a decline in percent of invested capital through 2023.

On the uprise over the period of 2019 to 2023 are (according to Carta):

- Energy (primarily cleantech) – which rose from 2% to 11%

- Hardware – rising from 6% to 10%

- Pharma and biotech – at 15% of all investment into startups, an increase over 12%

What of climate tech?

Well, the Inflation Reduction Act (IRA) will flow billions of dollars of capital into climate tech over the next decade, much of it matching and augmenting VC investment. Many leading VC firms have dedicated climate funds now, and we see these funds as new co-investors in the sectors in which we focus.

All in all, this is a great time to be innovating in climate tech.

What trends are driving innovation and investment?

As we see it, there are four key trends driving increased investment in the area of climate and sustainability tech:

- Economics: Investing in sustainability has to be a “yes and…”. It cannot be just about being environmentally conscious; there must be a strong alignment of sustainability with economic incentives too, for successful investments.

-

Automation plays into the economics of it, too, not just in traditional applications like automotive manufacturing, but also in adopting automation for in-plant circularity, wastewater treatment, and packaging processes, for example.

-

The concept of decentralization is also gaining momentum, especially in the context of the circular economy, where the focus is on reusing materials, reducing supply chain uncertainties, cutting costs, and minimizing costly waste streams.

And energy economics cannot be ignored, especially with the increasing discussions about the transition to electric vehicles (EVs) and alternative energy sources becoming mainstream (or cheaper).

Future risks, such as the pricing of carbon and water (both increasing), are also on our radar, and we actively consider these factors in our investment decisions, avoiding water or carbon-intensive processes where possible.

- Technology: In today’s fast-paced world, tools and technologies have become more powerful, user-friendly, and affordable than ever before. As an example, the growing popularity of ChatGPT showcases the capabilities of language models that can assist us in everyday tasks, like finding a recipe based on available ingredients. This is applicable in the realm of sustainability, too, where technology plays a crucial role in green chemistry. I mentioned during the conference the existence of a vast database containing every known chemical reaction, which enables us to explore more eco-friendly alternatives, such as using “available ingredients” like biobased feedstocks with low CO2 emissions.

-

The advent of cloud storage, computing clusters, and democratization of machine learning further accelerates innovation and accessibility.

-

When it comes to manufacturing, automation is just one piece of the puzzle; the industry is witnessing a transformative phase with the development of toll manufacturing, 3D printing, and other just-in-time manufacturing options. The possibility of outsourcing an entire supply chain, as demonstrated by the example of our portfolio company ZwitterCo, offers exciting potential for sustainable practices and efficient operations. Additionally, biotech and electrochemistry are now equipped with powerful tools like CRISPR, allowing scientists to move faster in their research and development. And the availability of affordable, user-friendly robotics makes it easier for startups to build and operate without the need for specialized engineers.

- Talent: A new generation of scientists is graduating with the ambition to start their own hard tech companies. Thanks to entrepreneurial programming like MIT’s disciplined entrepreneurship class and media coverage on success stories from accelerators like Y Combinator and Silicon Valley, as well as initiatives like the National Science Foundation I-Corps and Activate programs, we are witnessing a demystification of the startup journey. These brilliant minds are turning their theses into realities, fueling a wave of innovation in hard tech.

-

And we recognize the value of investing in companies that align with the values and desires of Generation Z – to engage in meaningful work with autonomy while collaborating with like-minded individuals. We seek out startups where people are excited to work, knowing that passion and dedication are vital drivers of success.

- Policy and Public Perception: The world of policy and public perception is constantly evolving, offering both opportunities and challenges in the sustainable investment landscape. Increased public awareness of air, water, and pollution issues has led to greater transparency and accountability from companies. Media attention on concerns like PFAS and water quality has drawn public attention to the state of drinking water across the country, driving more consumers to seek information about their local utility’s water quality.

-

At the local level, communities are becoming more aware of the environmental impact of carbon-producing industries, pressuring cities, counties, and states to take action against environmentally concerning activities.

-

Public companies are also responding to public opinion by setting carbon reduction and ESG-related targets, aligning with the growing interest in sustainability; 96% of the S&P 500 published a sustainability report in 2022.

As we move forward, there’s a clear trend of decarbonization and sustainability mandates trickling down the supply chain. Companies like Intel are already requiring their suppliers to report on and improve their manufacturing, logistics, and waste practices to adhere to sustainability goals. Moreover, initiatives like the Inflation Reduction Act (IRA) provide a roadmap for the country’s decarbonization strategy through the 2020s, further influencing investment decisions in the renewable energy sector and beyond.

How do we make money?

That’s a fundamental question in any venture, and in the world of sustainable hard tech investments, it’s essential to understand the different strategies that can lead to profitable outcomes:

- Taking more capital upfront for long-term gains: Investing in sustainable hard tech often requires a more substantial upfront capital investment, compared with traditional ventures. However, this upfront investment comes with significant benefits. One of the key advantages is the creation of Intellectual Property (IP) and establishing a competitive moat. Sustainable innovations often involve cutting-edge technologies and unique solutions, leading to the development of valuable IP. This, in turn, provides companies with a competitive advantage in the market, making it challenging for others to replicate their offerings easily.

- Exploring capital-efficient models: Founders in the sustainable hard tech space are continuously exploring innovative and capital-efficient business models. They recognize the need to replace traditional software returns with solutions that align better with sustainability goals. One emerging concept is “{blank} as a service,” where companies offer a service-oriented approach to address specific sustainability challenges. Such models focus on providing sustainable solutions in a more cost-effective and resource-efficient manner, ensuring long-term viability for both the company and its customers.

- Embracing smaller scale innovations: As supply chain disruptions and logistics challenges increase, there is a growing trend towards local solutions and smaller-scale innovations. Companies are exploring ways to integrate recycling processes within their facilities, reducing reliance on overseas supply chains. By producing input materials on-site from locally sourced raw materials, businesses can ensure greater control over their supply chain, increase resilience to external disruptions, and create a more sustainable and circular approach to production.

- Leveraging the circular economy: By investing in companies that adopt circular economy principles, investors can tap into the growing market demand for sustainable products and services. The circular economy not only benefits the environment but also presents promising opportunities for revenue generation and cost savings.

- Navigating the market transition: The market is undergoing a significant transition, driven by the increasing focus on sustainability and the urgency to address environmental challenges. Investors who can navigate and capitalize on this transition stand to gain substantial returns. As traditional industries face disruptions, sustainable alternatives offer attractive solutions. Investing in companies that lead the way in sustainable practices and eco-friendly innovations positions investors to capitalize on changing market dynamics and emerging opportunities.

Where we are investing

We continue to invest across a broad range of industries, but here are some of the key areas that were of interest to the participants in the conference focused on sustainable innovation in the automotive supply chain:

- Sustainable Materials – Circular Economy: Investing in companies that contribute to the circular economy is a key focus. Examples of our investments in this area include Pretred, a company that repurposes waste tires into construction blocks and highway barriers. By diverting tires from landfills and finding new applications for them, Pretred not only reduces waste but also contributes to sustainable infrastructure development.

-

Another promising investment is Vartega, a company specializing in carbon fiber recycling. Vartega’s innovative recycling process allows for the reuse of valuable waste carbon fiber, making it an essential player in the sustainable materials industry.

-

Additionally, there are biobased materials companies like Biosynthetic Technologies, which produces biodegradable base oils and lubricants, providing environmentally friendly alternatives to traditional petroleum-based products.

- Electrification: Investing in the electrification sector offers compelling opportunities to promote clean energy and reduce carbon emissions. A prominent company in this portfolio is Battle Motors, a leader in selling electric trash trucks. By electrifying waste management vehicles, Battle Motors contributes to cleaner and quieter communities while reducing greenhouse gas emissions.

-

Another area of interest lies in technologies related to electric vehicle (EV) battery reuse and recycling. Companies like Titan Advanced Energy Solutions utilize ultrasound technology to measure the state of health and state of charge of EV batteries, enabling efficient battery management and extending their lifespan.

-

Currents, meanwhile, operates an exclusive marketplace for original equipment manufacturer (OEM) battery packs, facilitating the recycling and repurposing of these essential components.

- Environmental: Investing in companies that address environmental challenges is vital to creating a sustainable future. For instance, Puraffinity specializes in capturing per- and polyfluoroalkyl substances (PFAS) from water, addressing a significant water pollution issue.

-

In the industrial wastewater treatment sector, companies like ElectraMet focus on the recovery of valuable materials like copper and chrome from industrial waste streams, promoting resource efficiency and reducing waste.

-

Circulor is making strides in traceability solutions for supply chains, starting with battery materials. By providing transparency and accountability, Circulor helps ensure the responsible sourcing of materials and promotes sustainable practices across industries.

- Infrastructure software solutions: Investing in software plays in infrastructure presents innovative ways to enhance sustainability and optimize asset management. Avenew, for instance, is pioneering road asset management plans, using software to optimize infrastructure maintenance and repair. By employing data-driven insights, Avenew enables better decision-making and resource allocation, leading to improved infrastructure efficiency and reduced environmental impacts. Such investments in infrastructure software contribute to building more resilient and sustainable urban environments.

There is an incredible amount of innovation taking place throughout the world, in many fields that have the potential to improve sustainability and mitigate the impact of the climate crisis.

Small wonder then, that if you ask about what we do at HG Ventures, it is hard to stop me.