HG Ventures’ Jon Schalliol shares some key moments from 2024, reflects on some of the firm’s activities from what was another year of uncertainty for venture capital, and looks ahead to what 2025 may have in store.

HG Ventures’ Jon Schalliol shares some key moments from 2024, reflects on some of the firm’s activities from what was another year of uncertainty for venture capital, and looks ahead to what 2025 may have in store.

HG Ventures was an early investor in Pretred, a company that takes waste tires destined for landfill or incineration, and turns them into high performance safety barriers. This video is an inside look at how HG Ventures is working with the Pretred team to help transform the sustainability of infrastructure.

Vartega is solving the world’s toughest advanced materials recycling challenges, reclaiming post-industrial carbon fiber that would otherwise go to waste and turning it into a valuable product for a host of manufacturing purposes. Watch the video to find out more.

“Too often, startups focus on developing their product or technology and leave IP considerations as an afterthought. This can be a costly mistake. If you don’t have a solid IP strategy in place early on, you might find yourself in a position where your technology isn’t as protected as you thought, or worse, that you’re infringing on someone else’s patents.”

Alex Rappaport is the founder and CEO of ZwitterCo, a startup that develops membrane solutions for the treatment of highly impaired water. In the wake of the company’s Series B raise, Alex sat down with HG Ventures’ Ginger Rothrock to discuss the importance of the relationship between founder and investor. They covered ZwitterCo’s origin story; what it takes to be a successful founder; what Ginger looks for in an entrepreneur; navigating critical milestones; and the importance of team.

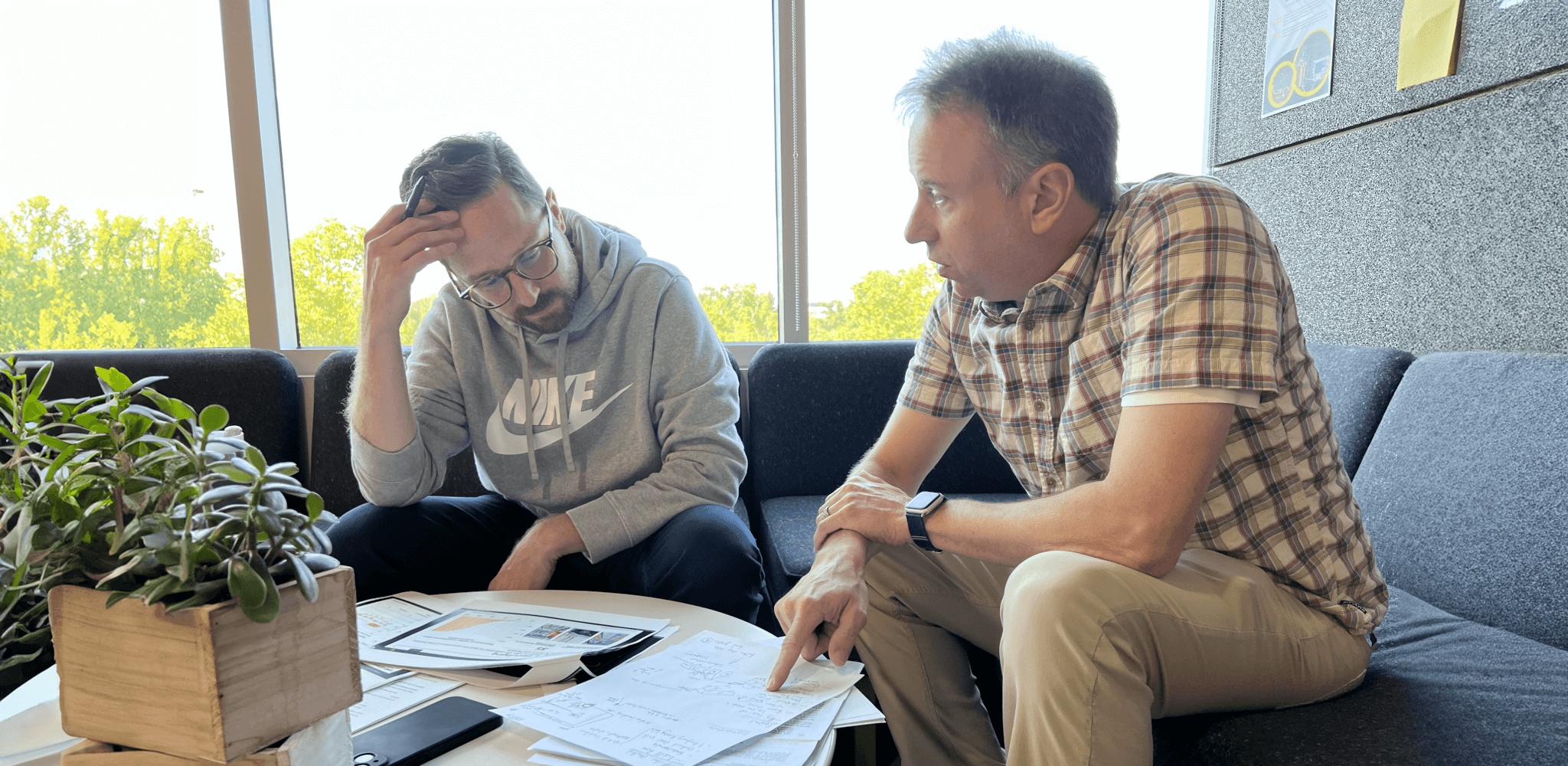

Battle Motors, a company transforming the heavy-duty commercial vehicle landscape, has a close partnership with HG Ventures. Following a recent visit to the company’s Ohio production facility, HG Ventures Managing Director, John Glushik, explains what makes this opportunity so special.

The due diligence process can be a daunting one for founders, and first time founders in particular can be caught off-guard with the volume and depth of information being asked of them. Here, HG Ventures’ Nick Arnold gives a VC’s perspective on what to expect.

At the heart of HG Ventures’ investment strategy is a desire to continue to add meaningful value to its portfolio companies beyond just writing a check. That requires an ongoing investment of time, relationships, and industry knowledge, which is why the team brought on Meghan Hunt as Platform Manager. In this blog post, Meghan outlines the concept of ‘platform’ in the world of venture capital.

The Heritage Group’s New Venture Group—which includes HG Ventures and The Heritage Group Accelerator—recently appointed Mitch Black to the newly created role of Entrepreneur-in-Residence. Here, Mitch outlines his vision for that role, and how founders stand to benefit.

With 25 years’ experience in the world of venture capital, HG Ventures’ Managing Director John Glushik has witnessed a wide range of investor behavior. Here John shares his perspective on what makes a good investor partner, and how his team applies this philosophy at HG Ventures.

Ginger Rothrock has led HG Ventures’ investments in a number of water-focused startups, and has built a reputation as a leading expert in the field. Ginger was invited to attend and speak at the Global Water Summit in London, and here summarizes some of the key issues and trends in that sector.

Denver-based Vartega is developing a new market for recycled carbon fiber. In this guest post, co-founder and CEO, Andrew Maxey recounts how a curiosity about bicycle frames ultimately became the foundation of a multi-million dollar business.